Starting July 1, 2025, Punjab National Bank (PNB) has officially removed the Minimum Average Balance (MAB) penalty for all savings account holders. This bold move is shaking up the banking scene across India and follows a growing trend among major public sector banks to make banking more inclusive and accessible.

Whether you’re a college student trying to save your first $100, a small-town farmer working with limited resources, or just someone tired of seeing penalty charges on your bank statement, this update is big news. But what does it really mean for you, and how should you adjust your financial habits moving forward?

PNB Removes Minimum Balance Penalty From July 1

| Feature | Details |

|---|---|

| Effective Date | July 1, 2025 |

| Applies To | All PNB savings account holders |

| Old Penalty Range | ₹10 to ₹2000 depending on location & shortfall |

| New Policy | No charges for failing to maintain minimum average balance |

| Purpose | Promote financial inclusion and ease of banking for all |

| Official Website | PNB India |

This is a game-changing move by PNB that speaks volumes about where Indian banking is headed—toward accessibility, fairness, and transparency. By removing the minimum balance penalty, PNB isn’t just updating its policies; it’s redefining how people interact with their money.

As an account holder, take this as an opportunity to re-engage with your savings goals, explore new financial tools, and finally stop stressing over those old-school penalty alerts.

What Is Minimum Average Balance (MAB) and Why Was It a Problem?

Minimum Average Balance, or MAB, is the average amount you needed to keep in your savings account over a month to avoid being charged. For example:

- Rural accounts might need ₹1000

- Semi-urban: ₹2000

- Metro cities: ₹5000 or more

If you didn’t keep this average, you’d get hit with a penalty ranging from ₹10 to ₹2000. Ouch, right?

This penalization model hurt folks who could least afford it. Many people—especially in rural areas or from low-income groups—would find their hard-earned money slowly eaten away by these fines. Even in urban areas, people living paycheck to paycheck couldn’t always maintain the required balance.

So when PNB announced the removal of MAB penalties, it was like finally getting rid of the bank’s version of the “junk drawer” fees.

Why Did PNB Remove the Minimum Balance Requirement?

Let’s be honest: Banking hasn’t always been the most people-friendly industry. But PNB is turning the tide.

This change aligns with:

- RBI’s long-standing push for financial inclusion

- Helping underbanked populations get easier access

- Following SBI, Canara Bank, and Indian Bank, who have already made similar changes

According to a 2023 RBI Financial Inclusion Index report, India scored 60.1 (out of 100), indicating moderate inclusion levels. Dropping MAB penalties is one way banks like PNB are aiming to raise that score by 2026.

How Does This Benefit You?

1. No More Surprise Charges

You can now run your savings account with zero balance without worrying about fines.

2. More Freedom for Low-Income Earners

Students, freelancers, farmers, gig workers—you name it—will no longer be penalized just for having lean months.

3. More Trust in the Banking System

Removing unnecessary fees builds trust, especially in communities that were previously hesitant to engage with formal banking.

4. Easier Account Maintenance for Elderly and Rural Populations

Many older folks or people living in areas with limited access to banks can finally keep accounts open without stress.

What Should You Do as a PNB Account Holder?

While this change is automatic, here are smart moves to make sure you’re maximizing this policy shift:

1. Stay Informed

Keep an eye on official updates from PNB. Visit their website or check your bank app notifications.

2. Use It to Build a Budget

Since you don’t need to worry about keeping a minimum balance, try using your account to manage monthly expenses, recurring bills, and even savings goals.

3. Link to UPI and Other Digital Platforms

Your account just got more flexible. Use UPI apps like Google Pay, PhonePe, or BHIM to make easy transactions without the worry of falling below a minimum threshold.

4. Explore More PNB Services

With one less rule to worry about, consider exploring other services like:

- PNB Fixed Deposits

- Digital Gold Saving

- Micro Loans and Agri Credits

Are There Any Downsides?

Not many, but here’s a heads-up:

- You might still need to maintain a balance if you’re using value-added services like overdraft protection or linked credit cards.

- Some legacy accounts or corporate-linked savings might still follow different rules. Always confirm with your branch manager or check the terms and conditions.

FAQs

Is this change valid for NRI accounts too?

Nope. The policy currently applies to domestic savings accounts only. NRIs should check specific account rules.

Will I still get interest on my savings?

Yes, absolutely. Interest rates stay the same, and your balance (whatever it is) continues to earn at prevailing rates.

Can I open a new PNB account with zero balance now?

Yes, most basic savings accounts are now zero-balance accounts by default.

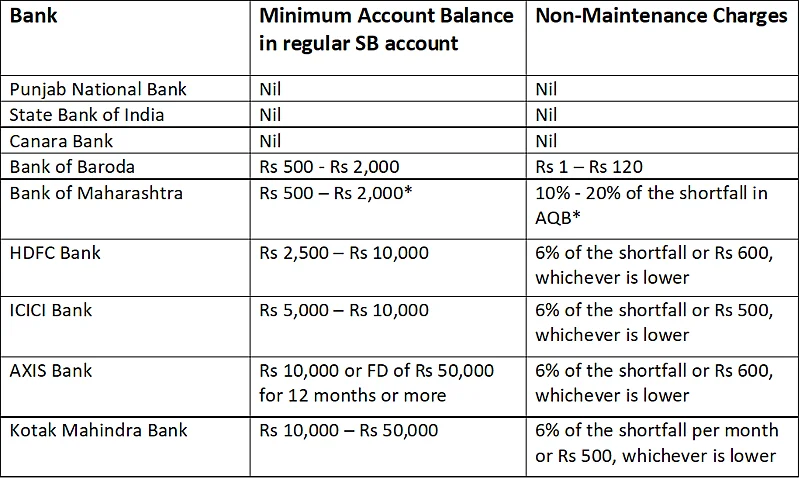

What about other banks?

Banks like SBI, Indian Bank, and Canara Bank have already removed MAB penalties. You can expect more banks to follow suit soon.

What if I use the account for business?

PNB’s new policy is for personal savings accounts. If you’re using it for business transactions, you should explore current accounts, which have different rules.